As of September 2nd 2019, first-time home buyers may be eligible to get a little extra government help to land their first home.

According to the Liberal-created program, the federal government will absorb five percent of monthly mortgage payments on existing homes and 10 percent on new builds.

So what’s the catch? There’s a few criteria to meet:

- You are either a Canadian citizen, permanent resident or non-permanent resident legally allowed to work in this country

- Your combined income cannot exceed $120,000 before taxes and deductions

- The equation they use for home value is typically around 4 times the income, meaning the houses that qualify would be a maximum of $560,000

- You have to pay an insurance premium to qualify (it protects the bank if you can’t make payments)

- You do have to pay it back (It’s not entirely free money, don’t forget you’ll have to return the loan either if you sell your home, refinance it, or simply at the end of the 25 years.)

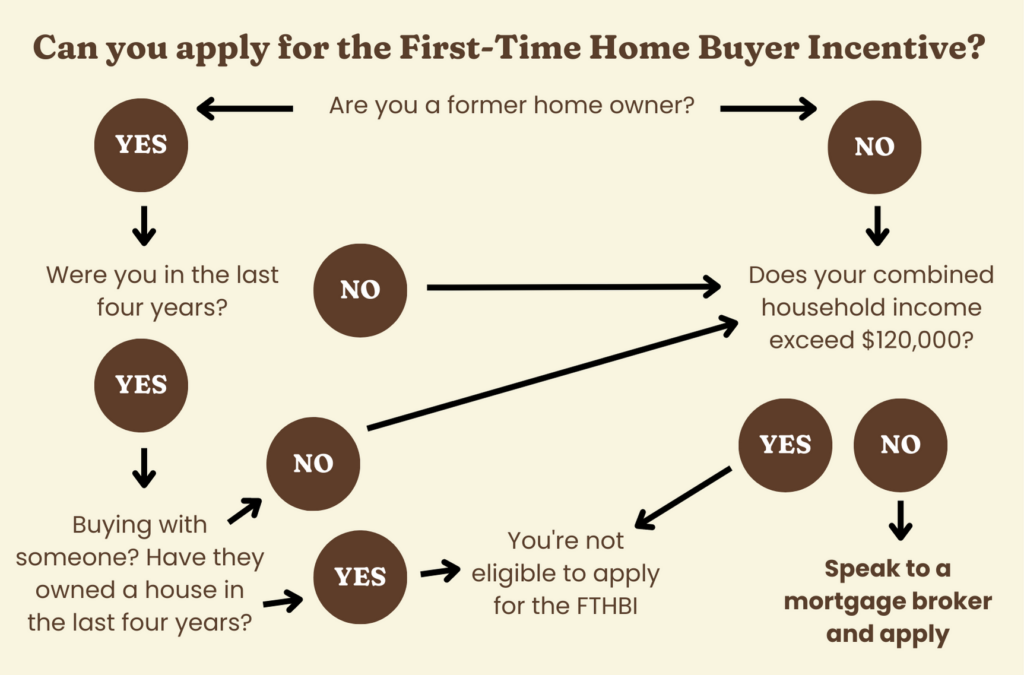

Have a more complicated situation and need to figure out if you even count as a first-time home buyer?

Want to learn more of find out if you qualify? Sit down with a mortgage broker and start asking questions! You can often do it over the phone, and if you need to get connected with a mortgage broker, I’m happy to make the connection. Shoot me an email at josh@seyergroup.ca, call or text me at 613-790-7679 or slide into my DMs on Instagram @joshhreyes.

Disclaimer: We are not mortgage specialists and the above should only be taken as loose information. Please contact a mortgage specialist or bank for formal advice. This information is not formal advice or instructions. The primary focus of this content is to provide basic education and any numbers or estimates provided are rough estimates. Any information used for a real estate purchase should first be consulted on a one-on-one basis with myself or another licensed professional.

Be the first to comment