The stress test was introduced to Canadian mortgages in 2018 as a way to ensure all Canadians can truly afford the homes in which they buy.

The concept is surprisingly simple: the Canadian government wants to make sure you can afford more than your set mortgage to account for rising rates and unpredictable circumstances.

Let’s look at an example of how one buyer’s situation would change from no stress test in 2017 to a required stress test in 2019:

Buyer receives a 2.83% mortgage with a 20% down payment, a five-year fixed mortgage, and a 25-year amortization period.

In 2017, they could purchase a home worth $726,939.

In 2019, they can only purchase a home worth $570,970.

Wait, WHAT?! Nearly a 22% difference.

It doesn’t sound great, but it does serve a purpose. And regardless, it’s the new reality home buyers face.

How does this work?

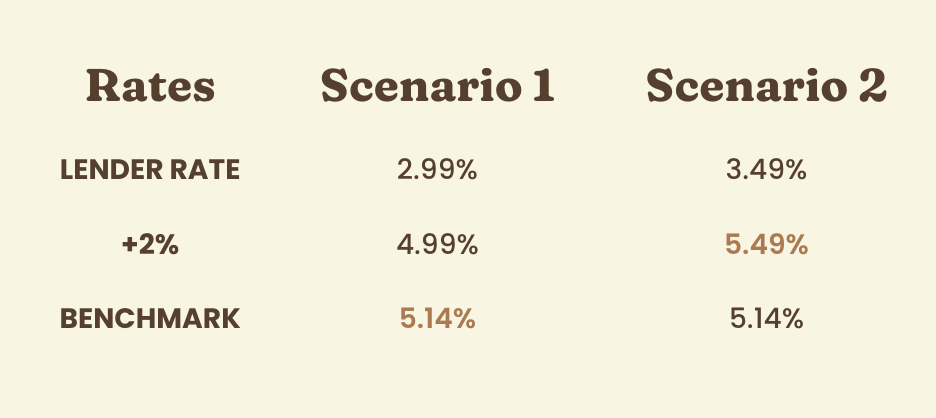

To put it generally, the stress test says the minimum qualifying mortgage rate must match the Canadian benchmark or the buyer must qualify for their contracted mortgage rate plus an added 2%.

An uninsured mortgage is any mortgage with a 20% down payment or higher. With the stress test, uninsured mortgages must be either the five-year benchmark rate published by the Bank of Canada or their contracted mortgage rate plus 2%. Unfortunately, you’ll be facing whichever is higher.

For insured mortgages (down payments under 20%), the buyer must use a five-year benchmark rate or contractual rate without adding the extra 2%.

Let’s put this into action for a mortgage with a 20% down payment to see how it works.

Still confused about the stress test or want to see how it affects your mortgage? Feel free to reach out to us at team@seyergroup.ca and we’d be more than happy to chat!

Disclaimer: We are not mortgage specialists and the above should only be taken as loose advice. Please contact a mortgage specialist or bank for formal advice.

Be the first to comment